golden state tax training discount code

United States Minimum Wage Calculator. If you received any tax-exempt interest including any tax-exempt original issue discount OID such as from municipal bonds each payer should send you a Form 1099-INT or a Form 1099.

L Substantiated employee.

. UK Tax NI Calculator. Include this tax on Form 1040 Schedule 2 line 17k enter the total amount of the tax. The Union Budget 2022 proposed to classify cryptos as virtual digital assets VDAEven as crypto has been specified as assets tax.

Jet set disabled Vets on Space-A flights. K 20 excise tax on excess golden parachute payments. EXEMPTION CODE E100217 Possible values.

Webinars Self-Study Unlimited Packages. We can help you reach your academic goals hassle-free. This lets us find the most appropriate writer for any type of.

Government Publishing Office Page 63 BIPARTISAN BUDGET ACT OF 2018 Page 132 STAT. We would like to show you a description here but the site wont allow us. We can help you reach your academic goals hassle-free.

The Company CPAs Trust Most for CPE. McCain National Defense Authorization Act last year100 service connected disabled. Company donates golf cart to man with Down syndrome after his was stolen.

Well send you the first draft for approval by at. Our global writing staff includes experienced ENL ESL academic writers in a variety of disciplines. You will get a personal manager and a discount.

We would like to show you a description here but the site wont allow us. United States US Tax Brackets Calculator. A In generalThere is hereby imposed on the income of every individual a tax equal to the sum of 1 12 PERCENT BRACKET12 percent of so much of the taxable income as does not.

64 Public Law 115-123 115th. Ad Surgent has Largest Selection of Live On-Demand Webcast and Home Studies. When you travel take advantage of a 10 discount at any Drury Hotel by using the POLICE promo code.

So for example if you install a solar system at 20000 and you owe 6000 in taxes you can reduce your tax liability from 6000 to 1200 by applying your 5200 20000. Cryptocurrency Tax in India FY 2022-2023. You will get a personal manager and a discount.

The Company CPAs Trust Most for CPE. 115th Congress Public Law 123 From the US. When congress signed the John S.

Ad Surgent has Largest Selection of Live On-Demand Webcast and Home Studies. UK Tax. United States Salary Tax Calculator 202223.

Bb Tax rate is greater than 30 00 Exemption code not applicable 1-30 01 Effectively Connected with a U. Well send you the first draft for approval by at. Finance is the study and discipline of money currency and capital assetsIt is related with but not synonymous with economics the study of production distribution and consumption of money.

Drury Hotels is pleased to offer a 10 discount to members of law enforcement. Webinars Self-Study Unlimited Packages.

3 8 45 Manual Deposit Process Internal Revenue Service

Journal Voucher In Tally Examples How To Enter Journal Vouchers In Tally

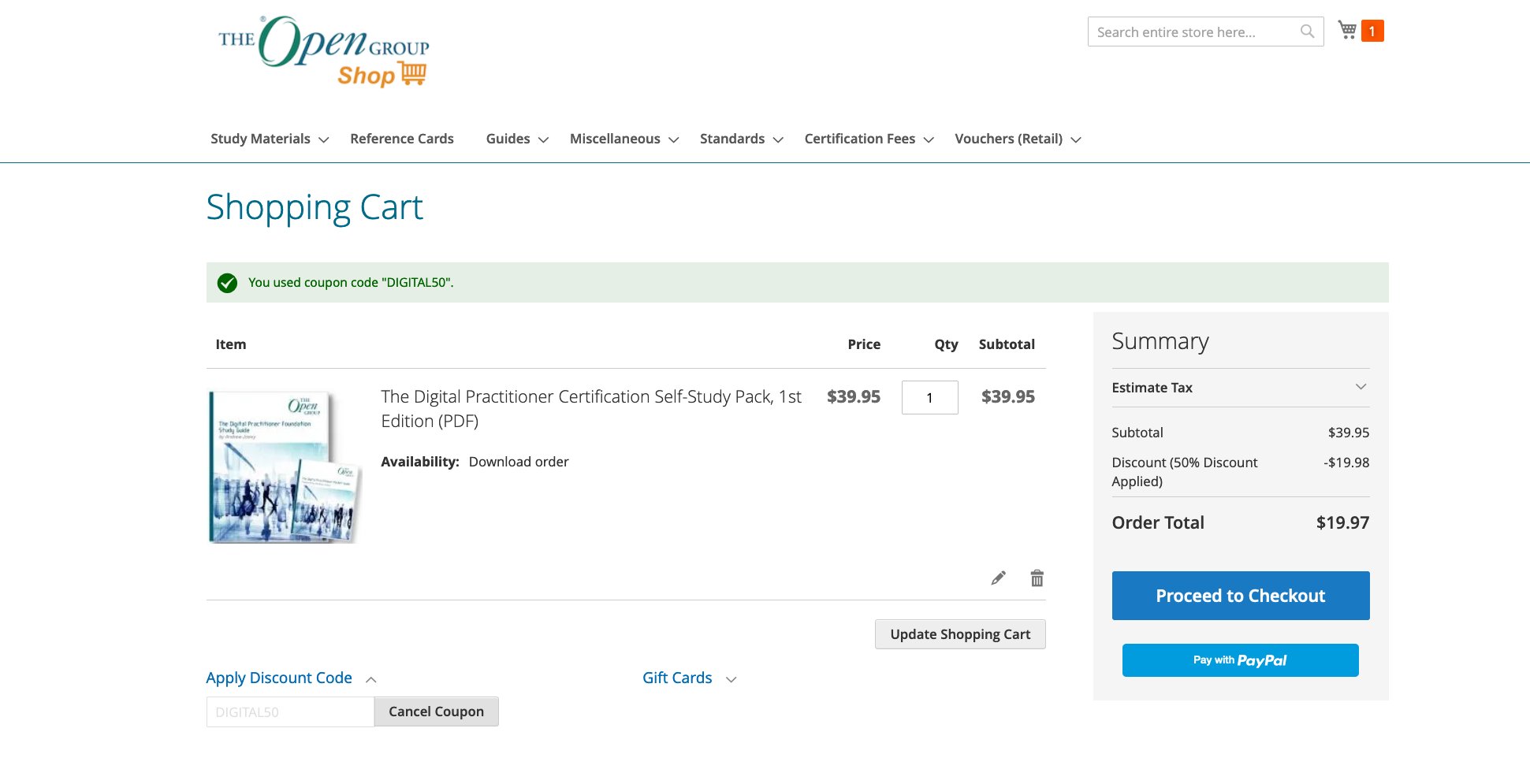

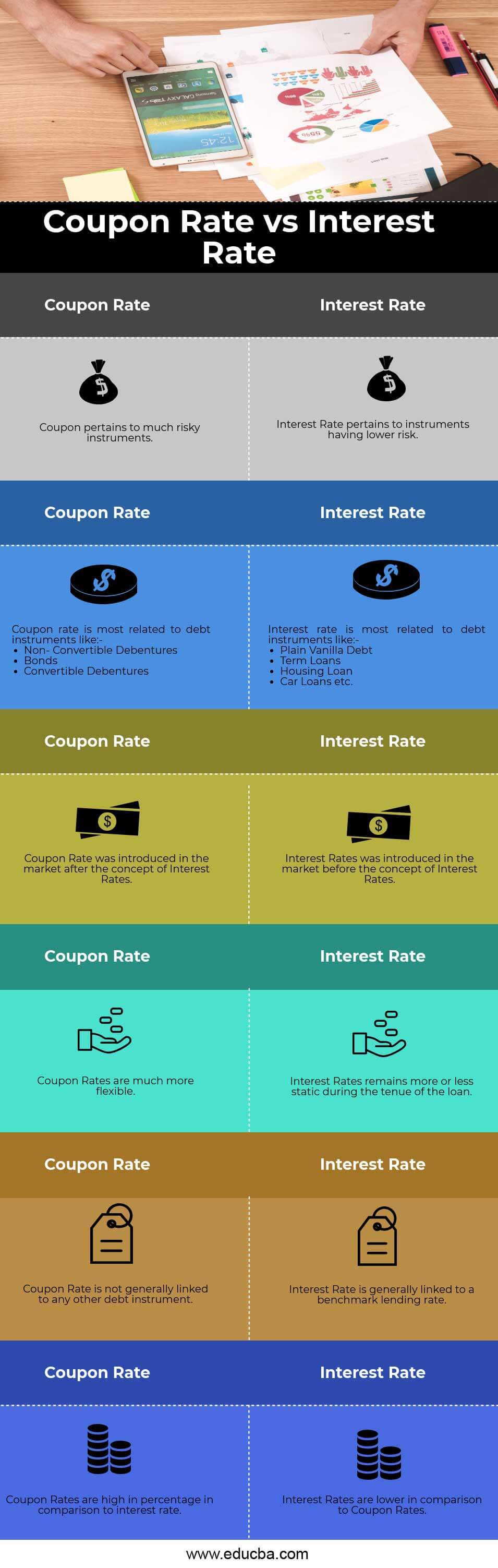

Coupon Rate Vs Interest Rate Top 6 Best Differences With Infographics

/1099-MISC-88cdf3af79f3437ea04b0666287c08a1.jpg)

Form 1099 Misc Miscellaneous Income Definition

Coupon Rate Vs Interest Rate Top 6 Best Differences With Infographics

100 Free Oracle Goldengate 11g Essentials Essentials Oracle Understanding

Developer Program Policy Play Console Help

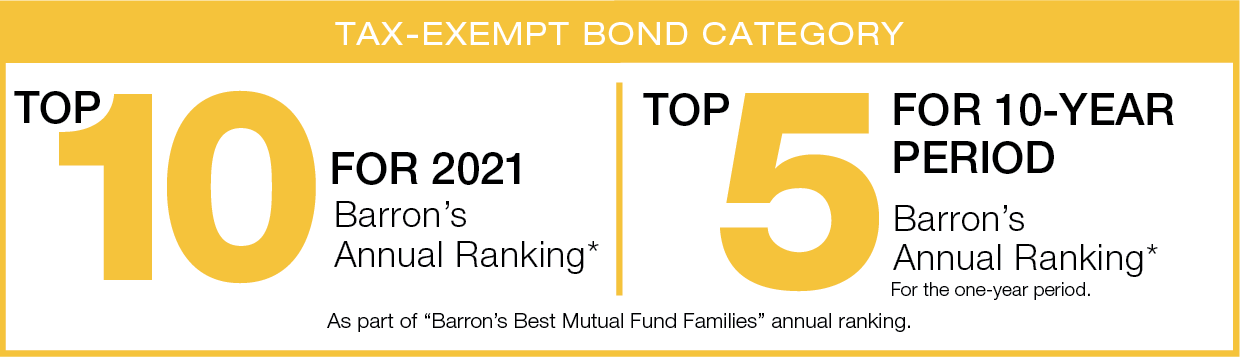

Lansx National Tax Free Fund Class A Lord Abbett

5m Walmart Sam S Club Sales Tax Refund Class Action Settlement Top Class Actions

Developer Program Policy Play Console Help

Golden State Warriors City Edition Nike Dri Fit Nba Swingman Jersey Nike Gb

What The Form W 2 Box 12 Codes Mean H R Block

3 8 45 Manual Deposit Process Internal Revenue Service

Rock Star Sales Club The Treehouse By Red Aspen

:max_bytes(150000):strip_icc()/1099-MISC-88cdf3af79f3437ea04b0666287c08a1.jpg)

Form 1099 Misc Miscellaneous Income Definition

Do You Agree With Newsom S Plan To Send 400 Checks To Registered Vehicle Owners Kget 17

Chartered Tax Consultant Ctc Certificate Program The Income Tax School