kern county tax collector address

Enter an 8 or 9 digit APN number with or without the dashes. Address Phone Number and Fax Number for Kern County Treasurer-Tax Collectors Office a Treasurer Tax Collector Office at Truxtun Avenue Bakersfield CA.

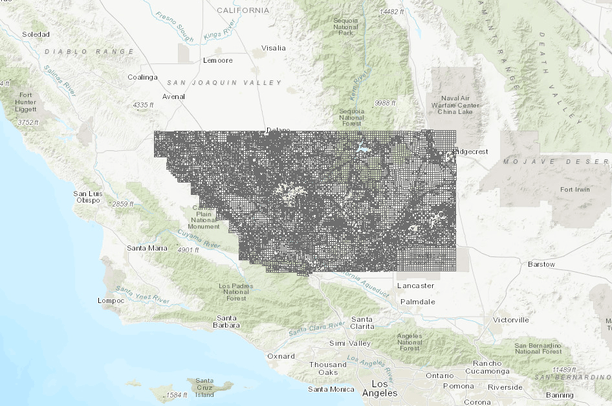

Parcels 2019 Kern County Data Basin

Search for Recorded Documents or Maps.

. And 500 PM Pacific Time on business days. The Kern County Assessor Tax Assessor Collector is responsible for appraising real estate and assessing tax on properties located in Kern County Assessor Ca. If you inadvertently authorize duplicate transactions for any reason and those duplicate authorizations result in payments returned for insufficient or uncollected funds an additional 27 returned payment fee for each duplicate.

The kern county recorder of deeds located in bakersfield california is a centralized office where public records are recorded indexed and stored in kern county ca. Prior Sale Results Links. Bakersfield California 93301.

Any email or voicemail received outside of these hours. Get Information on Supplemental Assessments. Change a Mailing Address.

Address Phone Number and Fax Number for Kern County Assessors Office an Assessor Office at Truxtun Avenue Bakersfield CA. Find Property Assessment Data Maps. The Kern County Treasurer-Tax Collector will present this ACH transaction to your bank for immediate payment.

Request a Value Review. Purchase a Birth Death or Marriage Certificate. Website support is available between 800 AM.

Name Kern County Assessors Office Address 1115 Truxtun Avenue Bakersfield California 93301 Phone 661-868-3485 Fax 661-868-3209. You can enter the APN with or without dashes. Maps are in the TIFF image format.

File an Assessment Appeal. Request a Value Review. Search for Recorded Documents or Maps.

Tax Sale Demos. How to Use the Property Search. No Fee is Necessary to Request a Value Review or to File an Assessment Appeal.

Learn about how to request a value review or file an assessment appeal without paying unnecessary fees to private companies. - A PROPERTY OWNER CANNOT BUY THEIR OWN. If you enter a valid APN and the map is not found email the Webmaster.

Find tax collector in Kern County CA on Yellowbook. Kern County Assessor-Recorder Assessor Maps Index. As a homeowner in the county you will receive a property tax bill from the Kern county assessor.

Change a Mailing Address. The county tax office is located in Bakersfield California. Kern County Property Records are real estate documents that contain information related to real property in Kern County California.

Many of your questions can be answered by clicking on the Tax Deed FAQ link on the left hand side of the page. Get reviews and contact details for each business including videos opening hours and more. Property searches are allowed only by parcel identification numbers APN and ATN and address not by owner name.

Search results will not include owner name. For all information regarding delinquent tax bills or a redemption from tax defaulted properties contact the County Treasurer-Tax Collector 1115 Truxtun Avenue 2 nd Floor Bakersfield CA 93301-4639 661 868-3490 or use the 24-hour information system see Item 4 below. For definitions of the terms used below visit the Assessor Terms page.

Kern County Administrative Office 1115 Truxtun Avenue Fifth Floor Bakersfield CA 93301. How to Use the Assessors Parcel Map Search. File an Assessment Appeal.

Find Property Assessment Data Maps. Purchase a Birth Death or Marriage Certificate. Kern County Assessors Office Contact Information.

Public Property Records provide information on homes land or commercial properties including titles mortgages property deeds and a. Jordan Kaufman Treasurer-Tax Collector httpswwwkcttccokerncaus Mary B. Get Information on Supplemental Assessments.

The property tax bill. It is important that we have your current mailing address to avoid unnecessary delays in delivery. File an Exemption or Exclusion.

If any of these payment or filing deadlines fall on a weekend or holiday the due date is the first business day following that weekendholiday. It is the owners responsibility to advise the Assessor when the. Enter a 10 or 11 digit ATN number with or without the dashes.

KERN COUNTY ASSESSOR CHANGE OF ADDRESS FORM Please Type or Print Property valuation information and tax bills are mailed to the address contained in Assessors Office records. Kern County Assessor-Recorder County Terms of Sale - March 2022 Kern County General Tax Sale Information Kern County Tax Sale Brochure List of Title Companies Tax Rate Areas Zoning Departments Zoning Information News and Announcements. Kern County Tax Collector Change Of Address By Maman November 28 2021 The property appraisers office maintains address records for the tax collectors office.

We hope this information will be helpful to taxpayers in Kern County. Kern County Treasurer-Tax Collectors Office Suggest Edit. Learn about the 10 Recorder Anti-Fraud Fee attached to the recording of several real estate instruments.

Bedard Auditor-Controller-County Clerk httpswwwauditorcokerncaus Kathleen Krause Clerk of the Board. File an Exemption or Exclusion.

Kern County Assessor Recorder S Office Facebook

Jordan Kaufman Kern County Treasurer Tax Collector Facebook

Kern County Real Estate Review Home Facebook

Kern County Treasurer And Tax Collector

Jordan Kaufman Kern County Treasurer Tax Collector Facebook

Important Notice Kern County Assessor Recorder

Kern County California Fha Va And Usda Loan Information

Kern County Treasurer And Tax Collector

Jordan Kaufman Kern County Treasurer Tax Collector Facebook

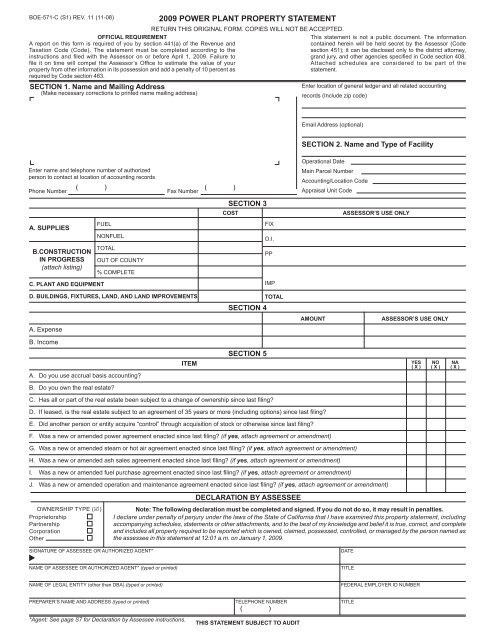

Power Plant Property Statement Kern County Assessor Recorder

Kern County Ca Tax Rate Areas Gis Map Data Kern County California Koordinates

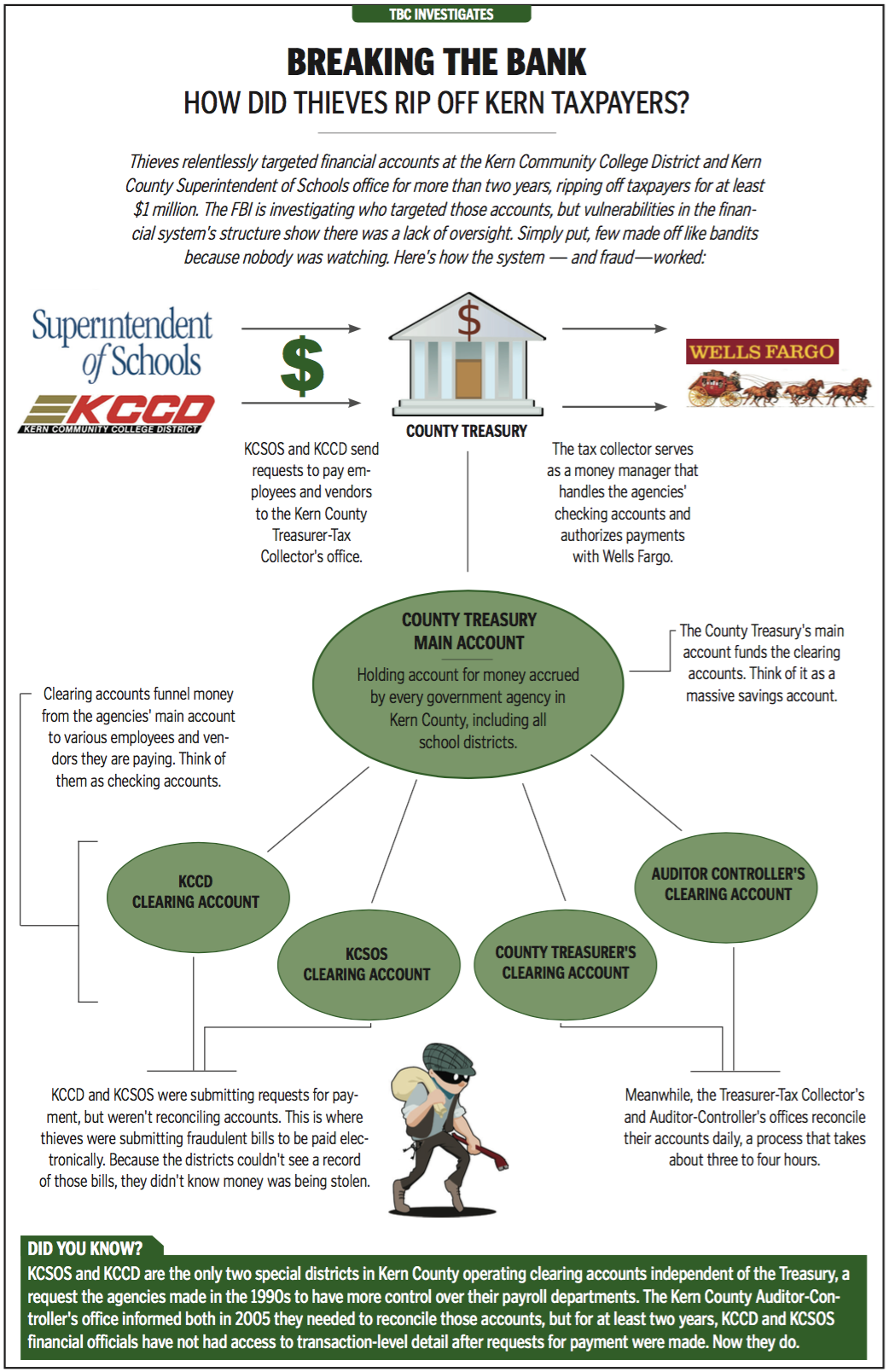

Lack Of Oversight Kept At Least 1 Million Of Taxpayer Losses Hidden News Bakersfield Com

How To Get To Kern County Recorder S Office In Bakersfield Ca By Bus

Jordan Kaufman Kern County Treasurer Tax Collector Facebook

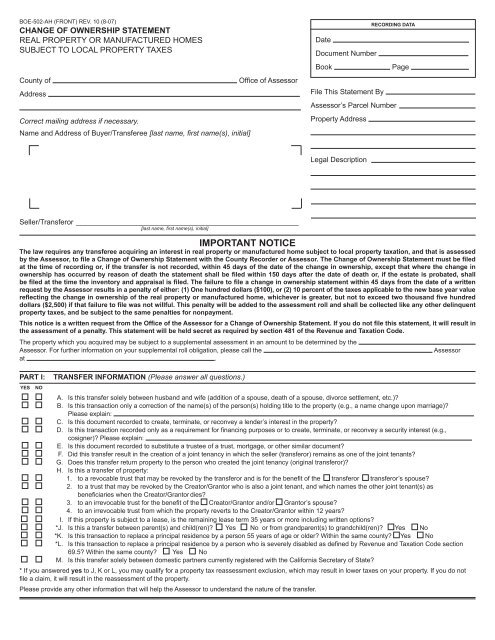

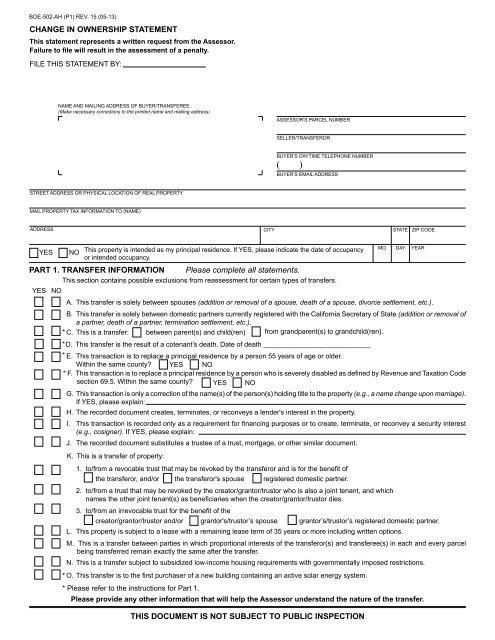

Form Boe 502 Ah Kern County Assessor Recorder

Kern County Treasurer And Tax Collector

Kern County Taxpayers Association Kern County Taxpayers Association